Table of Contents

ToggleAre you wondering how much it costs to build a mobile banking app like NatWest?

As digital banking is on the rise, financial institutions are competing to offer smooth mobile experiences for their customers.

Apps like NatWest simplify complex banking tasks, enabling users to handle bill payments, transfers, and account management with ease. However, the cost to build a mobile banking app like NatWest depends on various factors, including design, security, features, and compliance.

In this blog, we’ll explore the banking app development market, key growth trends, and the factors influencing mobile banking app development costs.

Whether you’re a startup or an established financial institution, understanding these insights will help you budget effectively and create a competitive banking app.

Banking App Development Market Overview

The financial landscape is shifting rapidly. According to Statista, the rise of neobanks highlights a significant move away from traditional banking. Consumers now prefer digital solutions over brick-and-mortar banks.

FinTech trends show a clear shift from in-person banking to mobile banking apps. These apps provide accessibility, cost-efficiency, and enhanced user experience.

Banks benefit by reducing operational costs, while users enjoy features like mobile check deposits, bill payments, transfers, investment tracking, and budgeting tools.

Banking App Growth Data

The global mobile banking market is growing fast. By 2028, it is expected to reach $1.36 billion.

Key industry statistics:

- 57% of millennials and 64% of Gen Z have financial accounts with nontraditional institutions (PwC survey).

- Mobile money transactions in emerging markets will hit $2 trillion by 2027 (Juniper Research).

With this rising demand, businesses looking to develop a mobile banking app like NatWest must consider market trends and technological advancements. A well-designed, feature-rich banking app can ensure long-term success in the evolving digital finance space.

What is a Mobile Banking App and How Does Natwest Work?

A banking app is a mobile application that brings financial services to your fingertips. It helps you manage money and much more without visiting the bank.

Checking balances, transferring cash, or paying bills, all you can do from your phone. These apps save time and make banking easy.

Now, let’s talk about NatWest.

It’s one of the UK’s top banking apps. NatWest stands out because it’s simple, secure, and user-friendly. You can check your account balance in seconds.

Need to send money? Tap a few buttons, and it’s done.

Want to pay a bill? No problem, it’s quick and simple.

The app even assists you set budgets or track spending. In 2024, NatWest earned £14.6 billion, proving its digital banking power. It sets a high standard with features like fast logins and safe transactions.

People like to use it for its convenience and reliability.

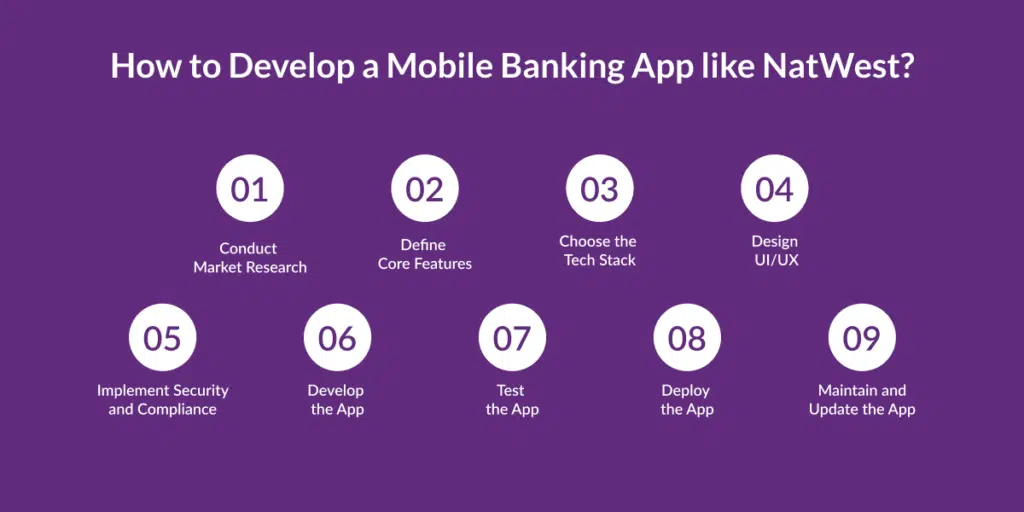

How to Develop a Mobile Banking App like NatWest?

Ready to build a mobile banking app like NatWest? Follow these steps to create a secure, user-friendly app that customers will love.

Let’s start!

Step 1: Conduct Market Research

Start by analyzing the market to understand user expectations. Study NatWest and other banking apps to see what features attract users.

Look at customer feedback and reviews to find pain points and areas for improvement. Research industry trends to ensure your app meets current and future demands.

Step 2: Define Core Features

Note the essential features your app must have. Think about what makes NatWest’s app successful, features like secure logins, instant transfers, bill payments, and transaction tracking.

Add user-friendly tools like budget management and financial insights to enhance the experience. Adding key features makes your app useful and competitive.

Step 3: Choose the Tech Stack

Step 4: Design UI/UX

Create a simple and visually appealing interface. Users should navigate easily without confusion. Use clear menus, smooth transitions, and intuitive buttons.

NatWest’s app has a clean and modern layout, you can take inspiration from it. A great UI/UX design keeps users engaged and increases app retention.

Step 5: Implement Security and Compliance

We know that the banking apps handle very sensitive financial data that’s why security is a top most priority.

Use end-to-end encryption, fingerprint or face ID authentication, and two-factor verification to protect user accounts.

Follow financial regulations and compliance standards like GDPR and PCI DSS to build trust and avoid legal issues.

Step 6: Develop the App

Once the plan is ready, start coding the app. Work with experienced developers who understand banking security and performance needs.

Focus on speed, responsiveness, and real-time transaction capabilities. A well-developed app should run smoothly even with high user traffic.

Step 7: Test the App

Before launching, conduct thorough testing. Check for bugs, security vulnerabilities, and app crashes.

Perform speed tests and compatibility tests to ensure a smooth user experience across different devices and operating systems. Fix issues before launch to prevent user complaints.

Step 8: Deploy the App

Once testing is complete, launch the app on Google Play and the App Store. Make sure users can download and register easily.

Promote your app through marketing campaigns, social media, and email newsletters to attract early adopters. A successful launch boosts your app’s credibility.

Step 9: Maintain and Update the App

After successfully launching your app, regularly update your app with bug fixes, security patches, and new features.

Listen to user feedback and improve the app based on their needs. Regular updates keep your app competitive and improve user satisfaction.

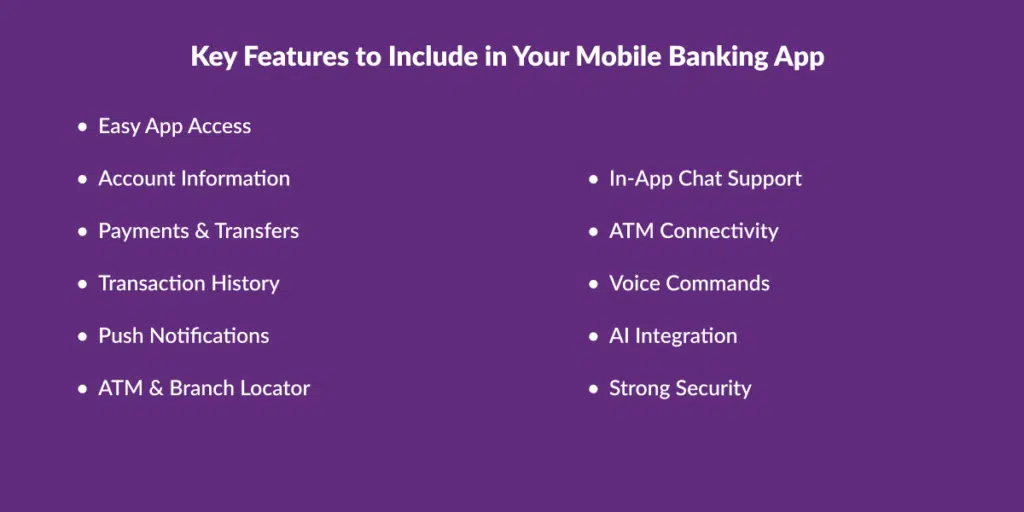

Key Features to Include in Your Mobile Banking App

While developing a mobile banking app like NatWest, it is necessary to add some basic to advanced features to your app so it keeps the user engaging.

Here are the must-have features to ensure a smooth, secure, and user-friendly experience.

1. Easy App Access

A banking app should offer quick and secure login options. Users don’t want to enter passwords every time, so features like fingerprint authentication, face ID, and PIN-based logins make access faster and safer.

Adding multi-factor authentication (MFA) such as a one-time password (OTP) via SMS or email increases app’s security.

2. Account Information

Users need instant access to their account details. The app should display account balance, recent transactions, credit/debit card details, loan accounts, and savings history in a simple and organized format. A well-designed dashboard helps users track their finances easily.

3. Payments & Transfers

One of the most important features is seamless money transfers. Users should be able to:

- Send money instantly to other users or external bank accounts.

- Schedule payments for bills, rent, or loans.

- Make peer-to-peer (P2P) transfers using phone numbers, emails, or QR codes.

- Pay merchants directly using contactless payments or UPI-based systems.

A smooth, error-free payment experience keeps users engaged.

4. Transaction History

Users should be able to track all their financial transactions in real time. The app should:

- Display a detailed record of payments, deposits, and withdrawals.

- Offer filters by date, category, or payment type to make searching easy.

- Allow users to download statements in different formats (PDF, Excel).

This helps users manage their spending and financial planning effectively.

5. Push Notifications

Real-time notifications keep users updated about their financial activities. The app should send alerts for transactions, low balances, bill due dates, failed payments, security warnings, and promotional offers. Users should also have the option to customize notifications based on their preferences.

6. ATM & Branch Locator

Many users still need access to ATMs or physical branches. A built-in map feature helps them find nearby ATMs and bank branches, showing:

- Live ATM availability (e.g., cash availability status).

- Branch working hours and services (e.g., loan assistance, document verification).

- Directions via GPS to the selected location.

This feature improves convenience and saves time.

7. In-App Chat Support

Customers may have queries about transactions, failed payments, or account issues. A 24/7 live chat or AI-powered chatbot can provide instant help without needing to visit a branch or call customer service. Advanced chat features may include:

- Automated responses for FAQs (e.g., “How do I reset my password?”).

- Live agent support for complex queries.

- Voice-enabled assistance for users who prefer speaking over typing.

Good customer support increases trust and user satisfaction.

8. ATM Connectivity

Cardless ATM withdrawals are becoming popular. Users can withdraw cash from ATMs using their mobile banking app instead of carrying a physical card. This can be done through:

- QR code scanning at the ATM.

- One-time PIN (OTP) authentication sent via the app.

This feature enhances security and prevents card fraud.

9. Voice Commands

Adding voice command functionality allows users to perform banking tasks hands-free. Users should be able to:

- Check their balance by saying, “What’s my account balance?”

- Make transfers with commands like, “Send $500 to John.”

- Set reminders for bill payments using voice assistants.

This feature improves accessibility, especially for visually impaired users or those who prefer voice interactions.

10. AI Integration

Artificial Intelligence (AI) in banking. AI-powered features can include:

- Spending insights: Analyze spending habits and provide recommendations.

- Budget tracking: Suggest ways to save money based on past expenses.

- Fraud detection: Identify unusual transactions and warn users.

- Personalized financial advice: AI chatbots can suggest better investment options or credit card plans.

AI makes banking more personalized and efficient.

11. Strong Security

Security is the most important part of any banking app. To protect user data and prevent fraud, your app must include:

- End-to-end encryption to secure transactions.

- Multi-factor authentication (MFA) for extra security.

- Fraud detection alerts for suspicious transactions.

- Auto-logout after inactivity to prevent unauthorized access.

- Secure API integrations to connect with third-party services safely.

A strong security system builds trust and ensures compliance with financial regulations.

Why is It Important to Understand the Banking App Development Cost?

Building a mobile banking app like NatWest comes with clear benefits, convenience, security, and happy users.

But there’s a crucial thing to focus on: the cost.

These costs can vary wildly based on factors like app complexity, platform choice, security needs, and features. Without knowing these, you might get a higher cost, unpredictable project.

Understanding the cost to build a mobile banking app before starting the development process is a smart choice.

This helps you to set realistic goals and boost your return on investment.

Whether you’re a bank upgrading your digital game or an entrepreneur dreaming of the next big step in the fintech sector, it increases the chances to win in the market while staying competitive.

How Much Does It Cost to Build a Mobile Banking App Like NatWest?

Curious about the cost to build a mobile banking app like NatWest?

The cost can vary with its complexity, features, and technologies. We have simplified the cost based on its features and complexity.

| Feature | Description | Cost (USD) |

|---|---|---|

| Authorization | Adds secure logins like passwords, fingerprint, or face ID. | $5,000 - $7,500 |

| Notifications | Sends alerts for fraud or low balances to keep users in the loop. | $2,000 - $3,000 |

| Access to Card Details | Lets users pay without typing card info every time. | $4,000 - $6,000 |

| Transactions & Payments | Covers transfers, bill payments, and auto-transfers, NatWest style. | $8,000 - $10,000 |

| Transaction History | Shows past spending for easy tracking. | $2,500 - $3,000 |

| Spending Analytics | Spots trends to help users manage money better. | $4,500 - $5,500 |

| In-App Chat Support | Connects users to help with a quick chat feature. | $3,750 - $5,250 |

| Splitting Bills | Makes sharing costs with friends super easy. | $8,000 - $11,000 |

| QR Code Scanning | Scans codes for fast, hassle-free payments. | $7,000 - $10,000 |

Total Rough Estimate: For a basic app it will cost $35,000 – $70,000.

Want advanced features such as top-tier security? The costs may reach to $70,000 or $100000, depending on your app development agency, location, and tech choices.

These are just a rough estimated cost, your project might differ.

Key Factors Affecting a Banking App Development Cost

Building a mobile banking app like NatWest isn’t the same for everyone.

Several factors shape the app development cost.

1. Banking App Type

Account management and bill paying are just two examples of the customized functionality that apps like NatWest’s provide its users.

They range from $100,000 to over $200,000. Aggregator apps, which range from $50,000 to $100,000, connect several banks into a single platform. The price tone is set by your selection.

2. App Complexity

Basic apps that do simple tasks like transfers and balance checks remain reasonably priced. The complexity (and cost) increases when bells and whistles like chat, analytics, or biometric logins are added. Additional features cost more money and time.

3. Development Time

A basic app takes 3 to 6 months. Complex ones, like NatWest, might need 12 to 18 months. Research, design, coding, testing, and deployment all add up. Faster timelines can trim costs, but quality matters.

4. Team and Expertise

Skilled developers make or break your app. North American teams charge $150-$200/hour, while Eastern Europe offers $50-$100/hour. Outsourcing to fintech app development services, like Developer Bazaar Technologies, can speed things up and save cash.

5. Design and User Experience

Users are attracted by a simple, intuitive design, such as NatWest’s. However, wireframes, testing, and research take time. Excellent design reduces expenses while increasing adoption.

6. Security and Compliance

Banking apps must have uncompromised security, including GDPR compliance, two-factor authentication, and encryption. Such requirements increase development costs while protecting users.

7. Technology Stack

While native coding (Kotlin for Android, Swift for iOS) doubles work, it improves performance. Because they work on both platforms, cross-platform solutions like React Native reduce costs. Make smart choices because they will affect your money in the future.

8. Third-Party Integrations

Although it adds value, connecting ID checks or payment gateways makes code more difficult. It’s that simple: more integrations mean higher costs.

9. App Maintenance and Support

Launch isn’t the end. Updates, bug fixes, and server upkeep run 15-25% of initial costs yearly. A solid app maintenance and support plan keeps your app alive.

These factors decide if you’re spending $30,000 or $100000 to develop a banking app like NatWest. Plan smart to keep surprises away.

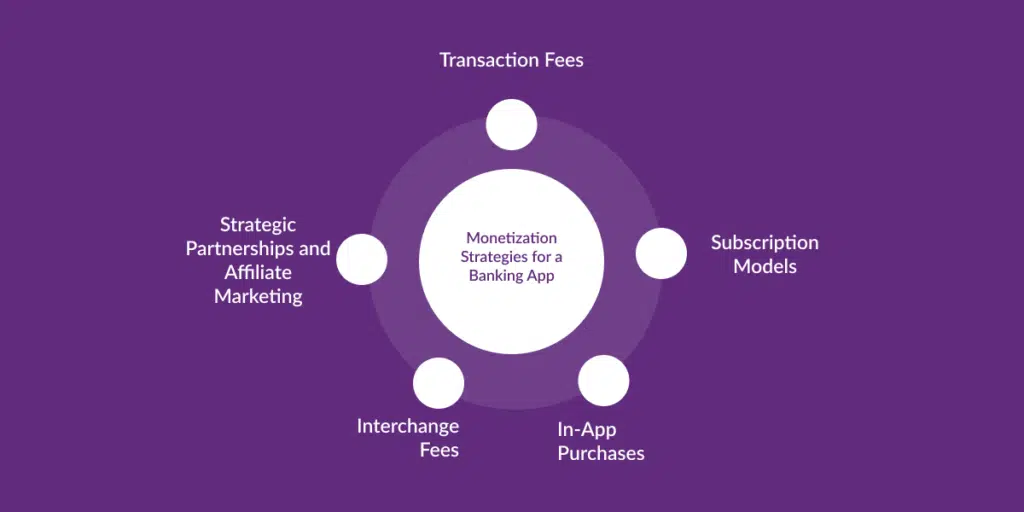

Monetization Strategies for a Banking App

Let’s check out some smart ways to generate revenue. Below strategies help to keep users happy and engaging, also generating more ROI.

1. Transaction Fees

For customized services, charge minimal fees. Consider sending money abroad or making payments very quickly. Apps excel at this; clients appreciate how easy it is. You receive consistent cash flow with minimal hassle.

2. Subscription Models

Provide the basic necessities for free, but engage customers with premium benefits. Cool extras like priority service and advanced budgeting tools are unlocked with a monthly cost. You benefit from steady money, and users gain more.

3. In-App Purchases

Allow customers to purchase add-ons from within the app. Perhaps a one-time service or a tool for financial planning? This increases your revenue and keeps them interested.

4. Interchange Fees

Get a small share each time consumers swipe their cards connected to the app. This fee is paid by merchants, not by your clients. It’s small, but it quickly adds up with many transactions, making it ideal for a financial app.

5. Strategic Partnerships and Affiliate Marketing

Team up with financial services or businesses. Provide users with offers or discounts via the app. Commissions are paid to you in exchange. It’s an interesting approach to increasing revenue while satisfying users.

These strategies work because they balance user value with profit.

Conclusion

Developing a mobile banking app like NatWest doesn’t have to be difficult. You can become as successful as NatWest with the correct development process, understanding the cost to build the mobile banking app and the right ways to monetize the apps, such as transaction fees, subscriptions, or partnerships.

Pay attention to what customers appreciate most: value, security, and ease of use. When you combine that with clever revenue-generating concepts, you’re ready to stand out.

The secret is to start strong and keep getting better, whether you’re providing financial app development services or app maintenance and support. Together, we can make your app idea profitable.

FAQs

Q1. How long does it take to develop a banking app like NatWest?

A: It takes 6 to 12 months. A basic version (MVP) is quicker, but a fully-loaded app needs more time for planning and polish.

Q2. What affects the app development cost for a banking app?

A: There are various things that affect the cost such as Platform choice (iOS or Android), features, design, security, and regulations all play a role. The development team’s experience and ongoing app maintenance and support matter too.

Q3. How much does it cost to develop a banking app like NatWest?

A: Expect $30,000 to $100,000 or more. Connect with Developer Bazaar Technologies as an expert app development agency for an exact quote tailored to your needs.

Q4. Why should businesses invest in digital banking apps?

A: They boost customer happiness with 24/7 access and speed. Plus, they cut costs, scale easily, and give data for smarter decisions. Users engage with the personalized benefits.

Q5. What features make a banking app like NatWest stand out?

A: They boost customer happiness with 24/7 access and speed. Plus, they cut costs, scale easily, and give data for smarter decisions. Users engage with the personalized benefits.

RM Mishra

Co-Founder

Developer Bazaar technologies