Table of Contents

ToggleBlog Summary: Artificial Intelligence in Banking & Fintech Applications is changing the way we handle money. From talking chatbots to smart fraud detectors, AI is making banking easier, faster, and safer. This blog explains how to implement AI in the Finance Industry. Whether you are curious about AI in banking or want to explore AI in fintech services, this guide is for you.

Artificial Intelligence (AI) in Fintech

AI in Fintech is now trending technology with future planning. It is helping banks and finance companies do things better, smarter, and quicker. From improving customer service to making secure payments and smart investment decisions, AI in Fintech Applications is reshaping the work.

Technologies like Generative AI, chatbots, and large language models are now common tools in the AI Banking Solutions toolkit. These tools help banks work faster, provide better service, and stay ahead of the competition.

By 2028, AI in banking and finance is expected to reach a value of $49 billion. That means more banks will use AI-powered tools to solve problems, support customers, and make smart decisions. Simply put, Artificial Intelligence in Banking & Fintech Applications is shaping the future of money.

How Does AI in Banking and Finance Work?

Ever wondered how AI works in fintech and banking? It’s actually quite simple. First, the system collects data like customer details, market trends, and financial records. Then it cleans and organizes this data so the computer can understand it.

Using smart tools called embedding models, the data is turned into numbers and stored in a special place called a vector database. APIs and plugins help connect everything, while an orchestration layer acts like a smart manager that guides the AI to find answers.

When someone asks a question like checking credit risk, the AI searches the data, finds the best answer, and shows it in an app or dashboard. Over time, it learns and improves through feedback. Advanced AI agents can even solve complex problems, while caching tools help it respond faster.

A validation layer checks the answers, and everything runs smoothly on cloud platforms like AWS. Implementing AI in Banking Solutions this way makes finance smarter, faster, and more efficient.

AI in fintech industry: Key statistics

Here are some interesting facts and numbers that show how fast AI in Fintech is growing:

The global fintech market is worth $340.1 billion. Out of that, AI in fintech services holds about $44.08 billion, and it’s expected to grow to $50 billion in the next five years. (Source: Fortune Business Insights)

Around 72% of companies already use AI in at least one part of their business. It helps with security, cost savings, and better customer support.

(Source: McKinsey)

67% of organizations plan to spend more on AI solutions and data tools. That means more smart tools will be used to improve services.

(Source: Accenture)

AI in banking is helping with faster and safer identity checks. It’s expected to save banks $900 million and reduce onboarding time by 30% by 2028.

(Source: Juniper Research)

Conversational AI & Virtual Assistants like chatbots help banks answer questions and solve problems 24/7. They have already reduced costs by up to 80% and become 25% more accurate.

(Source: IBM)

These numbers show how AI’s impact on the financial industry is massive and still growing. From saving time to saving money, AI in Banking & Finance Sector is changing how the world manages money.

8 Ways AI is Transforming Fintech Companies

AI in Fintech applications is helping companies serve customers better, stay safe from fraud, and make smarter decisions.

There are following 8 simple ways how Artificial Intelligence in Banking & Fintech Applications is making a big difference.

1. AI-Enhanced Customer Service

Many banks and financial apps now use AI-powered chatbots to talk to customers. These chatbots give quick answers, help with money transfers, and even offer financial tips. They are always available and can solve problems without any wait. This is one of the easiest ways AI in banking and finance helps both users and workers.

2. Improved Cybersecurity Measures

Fraud and cyber-attacks are big problems in finance. But AI in fintech services can stop many of these attacks before they happen. AI tools can spot strange patterns in transactions and stop them right away. This makes banking safer and builds trust with customers.

3. Predictive Analytics for Market Trends

AI in Fintech helps companies understand what might happen in the future. It looks at tons of data to find trends in how people spend money or how markets shift. This helps businesses plan better, create smart marketing campaigns, and offer new services at the right time.

4. Enhanced Credit Scoring Models

With AI banking solutions, lenders can now look at more data like mobile usage or social media habits, to decide if someone can repay a loan. This helps more people get loans, especially those without a long credit history. It’s a great way to make financial services fairer for everyone.

5. Effective Fraud Detection Strategies

AI in banking is super smart at spotting fraud. It looks at how people usually spend money and then watches for anything unusual. If it sees something odd, it alerts the bank right away. This stops fake transactions and protects your account. It’s much faster and smarter than old fraud systems.

6. User Behavior Analysis

AI in fintech applications can study how people use their money. For example, it can see what you like to buy or how often you save. With this information, companies can offer products that match your needs, like better savings plans or loan offers. This makes your banking experience more personal and useful.

7. Automated Financial Advisors

Have you heard of robo-advisors? These are smart AI tools that help you manage your money. They give advice, pick investments, and even make trades based on your goals. AI solution tools like this make it easy for anyone to start investing.

8. Data-Driven Strategic Planning

Banks and fintech companies use AI to plan for the future. AI can check all kinds of data from customer habits to market trends and suggest smart moves. This helps businesses grow, save money, and bring better services to users. Implementing AI in banking solutions helps companies make strong, smart plans.

AI use cases in the Banking and Financial Services Industry

Artificial Intelligence in Banking & Fintech Applications assist in making things easier and faster than ever. From detecting fraud to giving loan advice, AI in banking and finance is making everything easier for both banks and their customers.

1. Cybersecurity and Fraud Detection

Every day, people use banking apps to send money, pay bills, and shop online. With so many online transactions, there is a higher risk of fraud. That’s where AI in banking helps. It can spot strange or risky activities quickly and alert the bank.

2. Chatbots for Customer Support

AI chatbots are like smart helpers. They talk to customers, answer questions, and solve problems, any time of the day. These bots learn from past chats to improve their answers.

3. Smarter Loan and Credit Decisions

Most banks check your credit score before giving a loan. But sometimes, this score doesn’t show the accurate result. AI in loan lending can look at your spending habits, payment behavior, and even phone data to see if you are trustworthy.

4. Tracking Market Trends

AI in fintech applications can read news, analyze stock prices, and study market behavior to suggest when to invest. It can even warn when there is a financial risk. This helps banks make smart decisions and give better advice to customers.

5. Fast Data Collection and Analysis

Banks deal with huge amounts of data daily. AI can collect, organize, and analyze this data quickly, something that’s hard for humans to do manually. With AI solutions, banks can use this information to detect fraud, improve services, and make better financial choices.

6. Better Customer Experience

People want fast and smooth services. With AI in banking, customers can open accounts, apply for loans, or get financial help without waiting in long lines.

7. Risk Management

Events like economic slowdowns or currency changes can affect banks. With AI expert tools, banks can study past data and predict what might happen next. This helps them make safe decisions and prepare for risks.

8. Regulatory Compliance

Banks must follow many rules to stay safe and legal. But rules change often, and it takes time to keep up. AI can read new legal updates using NLP (natural language processing) and help banks stay on track. It supports human compliance teams by making their work faster and more efficient.

9. Predictive Analytics

AI can find patterns in customer behavior. These patterns help banks find new opportunities to sell more services, improve operations, or solve hidden problems. Predictive analytics is a key part of AI in fintech applications, offering insights that older systems often miss.

10. Process Automation

Banks do many tasks every day that are boring and repetitive. AI banking solutions use RPA (Robotic Process Automation) to complete these jobs faster and without errors.

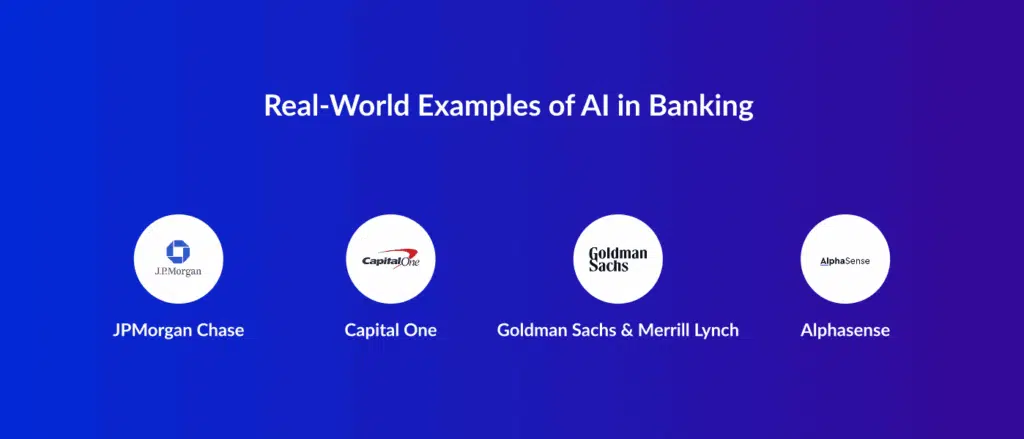

Real-World Examples of AI in Banking

There are some top banks that are using AI in Fintech and Banking:

- JPMorgan Chase: Uses AI to detect cyber threats like malware and phishing emails before they happen.

- Capital One: Created “Eno,” a smart chatbot that helps with online banking and fraud protection. They also use AI to create virtual card numbers for safer shopping.

- Goldman Sachs & Merrill Lynch: These investment banks use AI to study market trends and improve their trading decisions.

- Alphasense: Many banks use this AI-powered search engine to scan news, reports, and data for business insights.

Challenges in Implementing AI & ML in Banking Applications

Even though AI in banking and finance is helpful, it comes with a few challenges.

1. Data Security

Banks store a lot of sensitive information. If the data is not protected well, it can be stolen or misused. That’s why banks need a trusted AI solution provider who also offers strong security.

2. Lack of Quality Data

AI needs clean and structured data to work well. If banks don’t have the right data or if the data is messy, the AI may not give correct results. Banks must improve their data systems before starting with AI banking solutions.

3. Lack of Explainability

Sometimes, AI makes decisions that are hard to understand. If banks can’t explain how AI made a decision (like rejecting a loan), it could create problems. So, banks must make sure their AI in fintech applications are easy to understand and explain.

Benefits of AI in Banking and Fintech Applications

Artificial Intelligence in Banking & Fintech Applications is changing the way banks and financial companies work. AI helps them become faster, safer, and smarter. Here are the main benefits of using AI in Banking and Finance:

1. Better Decision-Making

AI can quickly study huge amounts of data. It helps banks make smart decisions about loans and investments. This means fewer mistakes, lower risks, and more profits.

2. Improved Customer Experience

AI-powered chatbots and virtual assistants give quick answers 24/7. Customers get help any time, even at night. This builds trust and keeps customers happy.

3. Faster and Smoother Operations

AI automation can handle boring and repetitive tasks like checking documents, monitoring fraud, or approving loans. This saves time, reduces errors, and cuts costs.

4. Stronger Security

AI improves data protection by using smart codes (encryption) to keep customer info safe. It can also spot cyber threats early and stop them before damage is done.

5. Smarter Risk Management

AI can spot early signs of financial risks like missed payments. Banks can act quickly to prevent losses. This helps protect both banks and their customers.

6. Lower Costs

With AI Banking Solutions, banks don’t need as many staff for routine work. AI also helps with smart marketing so banks can attract and keep more customers without spending too much.

7. Fairer Lending

AI makes credit scoring more fair by focusing only on financial data. It avoids unfair judgments based on age, race, or gender, making financial services more equal for everyone.

8. Automated Workflows

AI helps banks run their daily tasks on auto-pilot. This means fewer delays and better service. It’s expected to save banks about $70 billion by 2025.

9. Faster and More Accurate Results

AI is super fast and doesn’t make silly mistakes like humans sometimes do. It helps banks analyze information, spot problems, and serve customers more quickly.

10. Always Available

AI tools, especially when used in the cloud, work all day and night without a break. So, banks can offer nonstop support to customers anytime they need help.

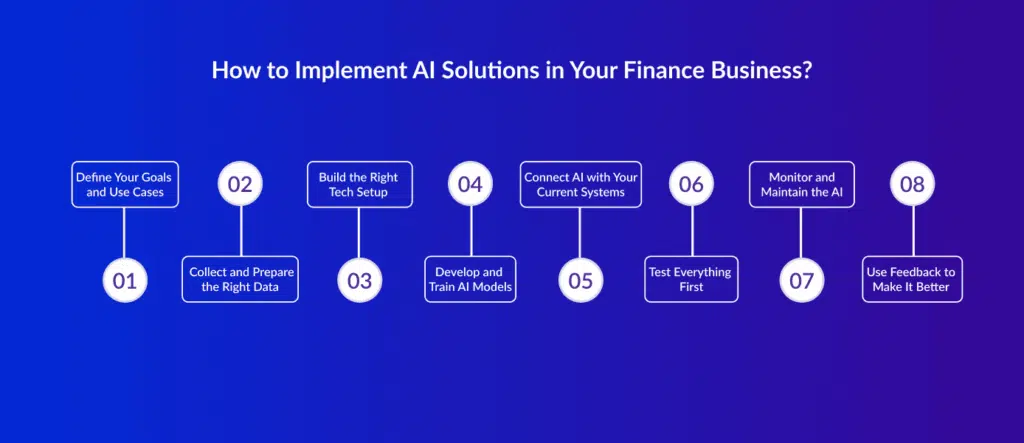

How to Implement AI Solutions in Your Finance Business?

Implementing AI in banking and fintech is like building a smart helper for your business. It takes a few important steps to make sure everything works smoothly. Here’s a simple guide to help you get started with AI banking solutions:

1. Define Your Goals and Use Cases

Start by asking: Why do you want to use AI?

- Do you want to stop fraud quickly?

- Do you want to help customers faster with chatbots?

- Do you want to offer smart saving tips or personal finance advice?

Once you know your goals, pick your AI use cases like fraud detection, risk checks, or automatic loan approvals.

2. Collect and Prepare the Right Data

AI in banking and finance works best when it has clean, correct data.

- Gather information like transaction history, customer profiles, and market trends.

- Check and clean the data. If your data is messy, your AI solution won’t work properly.

3. Build the Right Tech Setup

To implement AI, you need the right tools and technology.

- Set up strong servers and cloud platforms to handle AI tasks.

- Choose the right tools like machine learning, natural language processing (NLP), or data analytics, depending on what your business needs.

4. Develop and Train AI Models

This is where your AI expert team comes in.

- Data scientists and developers create smart models to learn from past data.

- These models improve over time by training with more and better data.

Example: A fraud detection AI will learn to spot fake transactions by studying old fraud cases.

5. Connect AI with Your Current Systems

Your AI banking solutions should work well with the systems you already use like your banking software, CRM, or transaction tools.

- Make sure everything is connected.

- Ensure that data flows smoothly between the old and new systems.

6. Test Everything First

Before using it fully, test your AI in fintech applications in a safe setting.

- See how it performs in real-world scenarios.

- Check if the results are correct and helpful.

7. Monitor and Maintain the AI

Keep an eye on how your AI solution is doing.

- Use real-time dashboards to track performance.

- Update and retrain your models when needed, especially when market behavior changes.

8. Use Feedback to Make It Better

Ask your team and customers for feedback.

- What’s working well?

- What needs improvement?

Use this information to keep making your AI in fintech services smarter and more useful.

Developer Bazaar Technologies is a top AI app development company that helps in adding AI in your finance businesses. Whether you want to fight fraud, give smart money advice, or speed up loan approvals, their AI experts can create custom tools that work just for you.

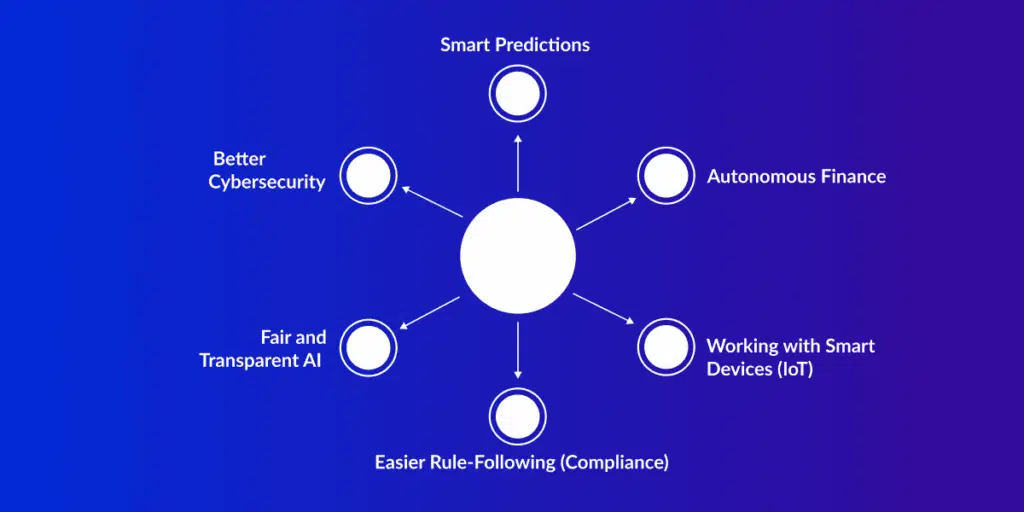

Future Trends of AI in Banking

The future of AI in Banking and Fintech looks very exciting. There are various future trends of AI that are coming in this competitive market in near future.

1. Smart Predictions

AI will help banks understand what customers need before they ask. It can predict customer actions, market changes, and financial risks early.

2. Autonomous Finance

AI will help people manage money automatically such as saving, investing, and budgeting—based on their personal habits and goals.

3. Working with Smart Devices (IoT)

Banks will use real-time data from smart devices like phones and wearables. This means more personalized and quick services.

4. Easier Rule-Following (Compliance)

AI will help banks follow government rules by checking and reporting things automatically. This reduces mistakes and saves time.

5. Fair and Transparent AI

Banks will focus on using ethical AI that is fair and open. They will make sure AI follows rules and treats all customers equally.

6. Better Cybersecurity

AI in fintech services will keep getting better at protecting customer data from hackers. It can quickly spot and stop any threats.

Conclusion

Artificial Intelligence in Banking & Fintech Applications is changing the financial world for the better. From improving customer service to protecting data and reducing costs, AI in Fintech makes banks smarter and more helpful.

As AI continues to grow, banks will offer even more useful, safe, and personalized services. With the help of the right AI solutions and experts, banks can keep moving forward and serve their customers better than ever.

FAQs

Q1: What is the future of AI in fintech industry?

A: The future of AI in Fintech includes smart financial planning, automatic budgeting, and better decision-making using predictions. It will make money management easier and more personal.

Q2: How to integrate AI into existing fintech platforms?

A: Start small, use good quality data, and make sure your AI team works closely with finance experts. Keep checking and improving the AI system regularly.

Q3: What are the challenges of implementing AI in fintech?

A: The main challenges are getting the right data, following strict rules, and finding skilled people who understand both AI and finance.

Q4: What are the differences between AI in fintech and traditional finance?

A: AI in Fintech Applications is quicker, more flexible, and focused on customer needs. Traditional finance focuses more on safety and long-term plans.

Q5: How does AI help in predicting customer behaviour for financial apps?

A: AI watches how users interact with financial apps like how often they log in or what services they use. It spots signs that a customer may leave and helps the company take action early.

RM Mishra

Co-Founder

Developer Bazaar technologies